The Eway Bill Login process is an essential step for businesses and transporters involved in the movement of goods under the Goods and Services Tax (GST) regime in India. The e-way bill system was introduced to ensure transparency, prevent tax evasion, and simplify the tracking of goods during transit. Whether you are a trader, manufacturer, or transporter, understanding how to log in, generate, and manage e-way bills is crucial for smooth compliance.

In this guide, we will explain everything about eway bill login, how the eway bill system works, and the complete process of eway bill generation in a simple and easy-to-understand manner.

What Is Eway Bill Login?

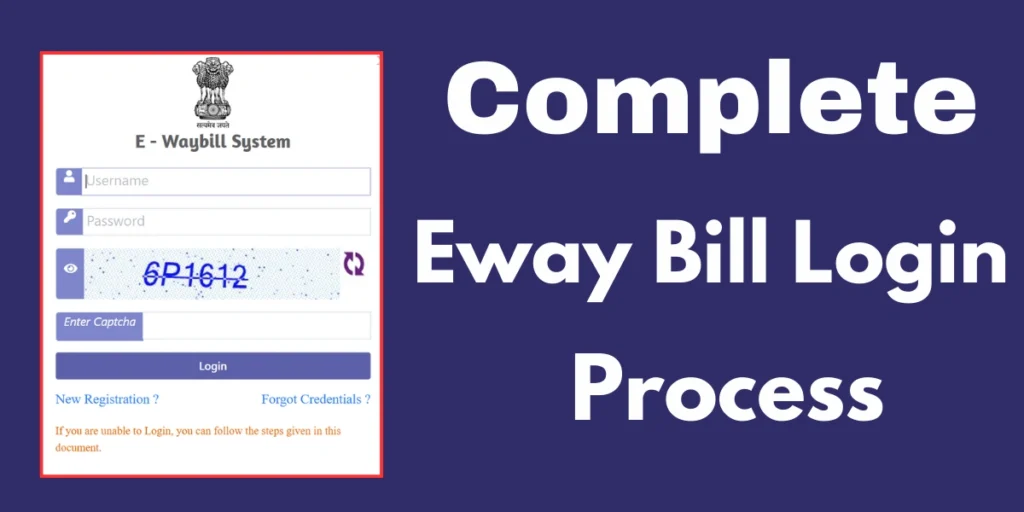

Eway Bill Login is the official authentication process that allows registered users to access the e-way bill portal. Using a valid username, password, and captcha, users can log in to create, modify, cancel, or track e-way bills online.

The login facility is available for:

- Registered taxpayers under GST

- Transporters enrolled on the portal

- Authorized representatives handling GST compliance

Once logged in, users can manage all e-way bills–related activities from a single dashboard.

Understanding the Eway Bill System

The eway bill system is an electronic mechanism developed by the GST Network (GSTN) to regulate the movement of goods valued above the prescribed limit. It replaces the earlier physical documentation system and brings efficiency to logistics operations.

Key Objectives of the Eway Bill System

- Monitor movement of goods across states and within states

- Reduce tax evasion and fraudulent transactions

- Enable paperless compliance for businesses

- Provide real-time information to tax authorities

The system generates a unique EWB number (EBN), which must accompany the goods during transit either digitally or as a printed copy.

Who Needs to Use Eway Bill Login?

Eway bill login is mandatory for the following users:

GST-Registered Businesses: Any registered supplier or recipient moving goods above the threshold limit must generate an e-way bill.

Transporters: Transporters carrying goods by road, rail, air, or ship must log in to update vehicle details or generate e-way bills if not created by the supplier.

Unregistered Persons (in specific cases): When an unregistered supplier sends goods to a registered recipient, the recipient must generate the e-way bill.

How to Access the Eway Bill Login Portal

The eway bill login process is straightforward and user-friendly. Follow these steps:

Step 1: Visit the Official Portal:-ewaybillgst.gov.in Open the official e-way bill website in your browser.

Step 2: Click on “Login”: On the homepage, select the eway bill login option.

Step 3: Enter Login Credentials: Provide your username, password, and the captcha code displayed on the screen.

Step 4: Access Dashboard: After successful login, you will be redirected to your dashboard where all services are available.

Features Available After Eway Bill Login

Once you complete the eway bill login, you can access multiple features, including:

- Create a new e-way bill

- Update vehicle or transporter details

- Cancel or modify e-way bills

- Generate consolidated e-way bills

- Track e-way bill status

- Access reports and history

These features help businesses manage logistics efficiently while staying compliant with GST regulations.

Eway Bill Generation Process Explained

Eway Bill Generation is one of the most important tasks performed after logging into the portal. Below is a step-by-step overview:

Step 1: Login to the Portal: Use your credentials to complete the eway bill login.

Step 2: Select “Generate New”: Choose the option for generating a new e-way bill from the dashboard.

Step 3: Enter Transaction Details: Fill in details such as:

- Supply type (outward/inward)

- Document type (invoice, challan, etc.)

- Document number and date

Step 4: Enter Goods Details: Provide product name, HSN code, quantity, taxable value, and applicable GST rates.

Step 5: Enter Transport Details: Add transporter ID, vehicle number, and distance to be traveled.

Step 6: Submit and Generate: After verification, submit the form. The system will generate an EWB number instantly.

Benefits of Using Eway Bill System Online

The eway bill system offers several advantages to businesses and authorities:

- Faster movement of goods

- Reduced paperwork and manual errors

- Improved compliance and transparency

- Easy tracking and verification

- Time-saving for transporters and traders

Best Practices for Smooth Eway Bill Generation

- Always verify invoice and transport details before submission

- Update vehicle details promptly in case of changes

- Keep a digital or printed copy of the e-way bill during transit

- Regularly check the validity period of generated e-way bills

Frequently Asked Questions (FAQs)

What is eway bill login used for?

Eway bill login is used to access the e-way bill portal to generate, update, cancel, and track e-way bills under GST.

Is eway bill generation mandatory for all goods movement?

Eway bill generation is mandatory for the movement of goods above the prescribed value limit, subject to GST rules and exemptions.

Can transporters generate e-way bills without GST registration?

Yes, transporters can enroll on the eway bill system and generate e-way bills using a transporter ID even without GST registration.

How long is an e-way bill valid after generation?

The validity of an e-way bill depends on the distance traveled and is calculated automatically by the system at the time of generation.